instructions form 8958

Form 8958⁚ Allocation of Tax Amounts

Form 8958 helps married couples and registered domestic partners filing separately in community property states allocate income and deductions fairly, ensuring accurate tax reporting for both individuals. It’s crucial for compliance.

Who Needs Form 8958?

Form 8958 is essential for married couples residing in community property states who opt to file their federal income tax returns separately (Married Filing Separately status). This includes Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. The form is also vital for registered domestic partners (RDPs) domiciled in California, Nevada, or Washington, reflecting the unique legal considerations surrounding community property and RDPs in these states. In essence, if you’re married or an RDP in a relevant community property state and filing separately, Form 8958 is required to properly allocate community income and deductions between you and your spouse or partner. Failure to use this form could lead to inaccurate tax reporting and potential penalties.

Community Property States and Filing Separately

In community property states, income and assets acquired during marriage are generally considered jointly owned by both spouses. However, when a couple files separately, each spouse must report their share of the community income and deductions. This is where Form 8958 becomes crucial. It provides a structured method for allocating these shared resources. The IRS requires this detailed breakdown to ensure accurate reporting and prevent discrepancies. Without Form 8958, the tax system wouldn’t have a clear record of how community property income is divided between spouses filing separately. This form ensures fairness and transparency in the tax process; Properly completing Form 8958 is vital to avoid potential tax-related issues arising from filing separately in a community property jurisdiction.

Registered Domestic Partners (RDPs) and Form 8958

Form 8958 extends its reach beyond married couples to encompass registered domestic partners (RDPs) in specific states. Similar to married couples filing separately in community property states, RDPs in California, Nevada, and Washington, who are legally recognized as such, must utilize Form 8958 to allocate community income and deductions. The allocation process mirrors the one used by married individuals filing separately, ensuring that each partner accurately reports their share of jointly held assets and liabilities. This equitable distribution is essential for tax compliance and prevents potential discrepancies when each partner files their individual tax return; The IRS recognizes the legal standing of RDPs in these states and requires the use of Form 8958 to correctly reflect their financial situations. Therefore, understanding and correctly completing this form is as crucial for RDPs as it is for married couples in the same circumstances.

Understanding Community Property

Community property laws define assets acquired during marriage as jointly owned, regardless of individual earnings. This impacts tax filings for those in community property states.

Defining Community Property

In community property states, assets acquired during marriage are generally considered jointly owned by both spouses, irrespective of who earned the income or holds the title. This includes income, property, and debts accumulated from the marriage’s commencement until its dissolution. The precise definition can vary slightly depending on the specific state’s laws, with some states having nuances in how certain types of property are categorized. For example, some states make distinctions between separate property and community property, considering separate property to be anything owned before the marriage or received as a gift or inheritance during the marriage. Understanding these state-specific rules is vital for accurate tax reporting, particularly when filing separately. Failure to properly differentiate can lead to incorrect tax liability calculations, potentially resulting in penalties or audits. Consulting a tax professional or reviewing the specific laws of the relevant state is highly recommended.

Identifying Community vs. Separate Property

Distinguishing between community and separate property is crucial when completing Form 8958. Separate property consists of assets owned before the marriage, received as gifts or inheritances during the marriage, or acquired using solely separate funds; Community property, conversely, encompasses assets acquired during the marriage using community funds. This includes income earned by either spouse, jointly held assets, and property purchased with marital funds. Careful record-keeping is essential; maintaining documentation of all assets and their origins is recommended. This could include bank statements, property deeds, and income records. Ambiguous situations may require professional legal or tax advice to determine the correct classification. Incorrect classification can lead to significant tax implications. The IRS provides guidance, but state laws may vary, highlighting the need for precise record-keeping and potentially professional assistance.

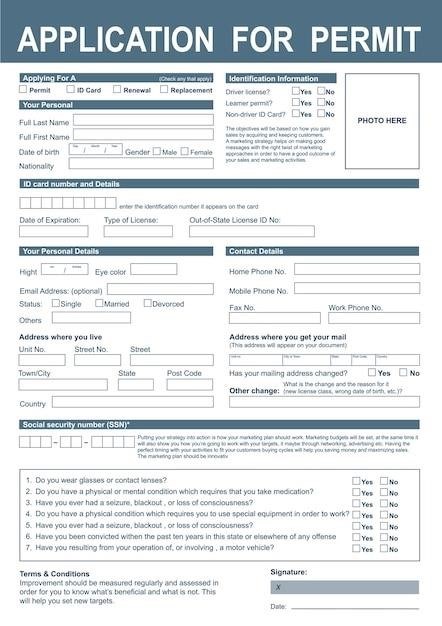

Completing Form 8958

Accurately allocate income and deductions on Form 8958, ensuring each spouse reports their correct share of community property income and their separate income. Attach to your tax return.

Allocating Income and Deductions

Carefully distinguish between community property income (earned jointly during marriage or domestic partnership) and separate property income (earned individually). Community property income, such as wages, interest, dividends, and capital gains earned during the marriage in a community property state, must be divided equally between spouses filing separately. Each spouse reports half on their individual return.

Separate property income, such as inheritance or gifts received before the marriage or during the marriage from a source outside the community, belongs solely to the receiving spouse and is reported entirely by that individual. Deductions are allocated similarly; community property deductions are split evenly, while separate deductions are claimed solely by the individual who incurred them. Accurate allocation is vital for avoiding errors and potential tax penalties. Consult a tax professional if needed for complex situations or ambiguities.

Reporting Separate Income

On Form 8958, reporting separate income is straightforward. This refers to income earned individually by each spouse or registered domestic partner, completely independent of the marital or domestic partnership community income. Examples include inheritances received solely by one partner, gifts from non-community sources, or income generated from assets owned solely before the marriage or partnership. Each person reports their separate income in full on their respective tax return.

Crucially, this separate income is not subject to the 50/50 split applied to community income. The IRS requires clear identification of each income source as either community or separate property. Inaccurate reporting can lead to penalties. Maintain detailed records of all income sources, including documentation such as pay stubs, bank statements, and 1099 forms, to support the accuracy of your filings. If any uncertainties arise, it’s advisable to seek professional guidance from a tax advisor.

Attaching Form 8958 to Your Return

After meticulously completing Form 8958, allocating community and separate income accurately, the final step is attaching it to your individual tax return. This form serves as crucial supporting documentation, justifying the income and deduction figures reported on your personal return. Failure to include Form 8958 can result in delays in processing your return and may even trigger an audit. Ensure the form is securely fastened to your return—stapling is generally sufficient.

The IRS requires this attachment to verify the accuracy of your reported income and deductions, especially in community property situations where the allocation of shared income can be complex. Keep a copy of both your completed Form 8958 and your tax return for your records. This provides a safeguard should any queries arise during the processing of your tax return. Remember, accurate and complete filing is essential for a smooth tax season.

Software and Form 8958

Many tax software programs support Form 8958, simplifying the allocation process. Manual entry might be needed depending on the software’s capabilities.

Tax Software Compatibility

Tax software compatibility with Form 8958 varies. Some programs automatically handle the allocation of community property income and deductions when filing Married Filing Separately (MFS) returns in community property states. These programs often have built-in features to guide users through the process, ensuring accurate reporting. However, not all tax software packages offer this integrated functionality. If your chosen software doesn’t directly support Form 8958, you may need to manually enter the allocated amounts from your Form 8958 into your tax return. This manual entry requires careful attention to detail to avoid errors. Before using any tax software, check its features to determine if it automatically handles Form 8958 or if you’ll need to manually input data. Understanding your software’s capabilities will streamline your tax preparation and reduce the risk of mistakes. Always double-check your entries to confirm accuracy before filing your tax return.

Manual Allocation of Income

If your tax software lacks automatic Form 8958 support, manual allocation is necessary. This involves meticulously calculating your share of community income and deductions. Begin by identifying all sources of community property income – wages, interest, dividends, etc. Carefully determine which income and expenses are classified as community property versus separate property, adhering to your state’s specific community property laws. Then, divide the community income and deductions equally between you and your spouse or registered domestic partner. Record these amounts on Form 8958, clearly detailing each source. For separate income and deductions, report the full amounts. After completing Form 8958, transfer your allocated share of community income and deductions to your tax return. Double-check all calculations to minimize errors. Accuracy is crucial, as any discrepancies can lead to delays or penalties. Keep detailed records of your calculations for future reference.