python finance pdf

Python is widely adopted in finance for its flexibility and extensive libraries, enabling data analysis, algorithmic trading, and machine learning. Its ecosystem supports generating financial reports and visualizations in PDF format, making it a versatile tool for both beginners and experts in the field.

1.1. Overview of Python’s Role in Financial Applications

Python is a cornerstone in financial applications, enabling efficient data analysis, algorithmic trading, and machine learning. Its libraries, such as Pandas and NumPy, streamline data handling, while tools like Matplotlib and Seaborn facilitate visualization. Python also supports generating financial reports in PDF format, making it indispensable for tasks ranging from portfolio management to risk assessment and quantitative analysis in the finance sector.

1.2. Key Features of Python for Financial Data Analysis

Python’s flexibility, coupled with libraries like Pandas and NumPy, makes it ideal for financial data analysis. It excels in handling large datasets, performing statistical computations, and creating visualizations. Tools like Matplotlib and Seaborn enable detailed financial plots, while its ability to generate PDF reports ensures comprehensive data presentation, making Python a powerful tool for data-driven financial insights and decision-making.

Importance of PDF in Financial Data Processing

PDFs are a standard for secure, professional financial reporting due to their universality, data integrity, and encryption capabilities, making them essential for sharing sensitive financial information.

2.1. Generating Financial Reports in PDF Format

Python libraries like fpdf, ReportLab, and pdfkit enable seamless creation of structured financial reports in PDF format. These tools support embedding tables, charts, and graphs, ensuring professional and consistent presentations of financial data. Automated PDF generation enhances efficiency, allowing businesses to produce and share detailed financial insights securely and efficiently, maintaining data integrity and readability across platforms.

2.2. Tools for Creating and Manipulating PDFs in Python

Python offers powerful libraries like ReportLab, PyPDF2, and pdfplumber for creating and manipulating PDFs. These tools enable users to generate financial reports, merge documents, and extract data efficiently. ReportLab excels at creating PDFs from scratch, while PyPDF2 handles merging and encryption. pdfplumber simplifies text extraction, making it ideal for financial data processing and analysis. Together, they streamline PDF workflows in financial applications.

Data Analysis with Python in Finance

Python excels in financial data analysis with libraries like Pandas and NumPy, enabling efficient data processing and visualization, crucial for deriving actionable insights in finance.

3.1. Handling Financial Data with Pandas

Pandas simplifies financial data manipulation, offering efficient data structures like DataFrame and Series. It enables cleaning, analyzing, and visualizing financial datasets, including time series and portfolio data, with ease. Key operations such as data merging and reshaping are streamlined, making it a cornerstone for financial data processing and analysis in Python.

3.2. Data Visualization for Financial Insights

Data visualization in finance transforms complex datasets into actionable insights. Libraries like Matplotlib and Seaborn enable creation of tailored plots, such as line charts for stock prices or bar charts for portfolio comparisons. Interactive tools like Plotly enhance exploration, while heatmaps and scatter plots reveal correlations, aiding in risk assessment and investment decisions, making data-driven strategies more accessible and effective for financial professionals.

Machine Learning in Financial Applications

Machine learning in finance leverages Python’s libraries like Scikit-Learn and TensorFlow for predictive modeling, risk analysis, and algorithmic trading, enabling smarter investment decisions and portfolio optimization.

4.1. Using Scikit-Learn for Financial Predictions

Scikit-Learn is a powerful library enabling financial predictions, such as stock price forecasting and credit risk assessment. It provides algorithms like linear regression, decision trees, and SVMs, which can be applied to historical data for predictive modeling. By integrating with Pandas for data handling and Matplotlib for visualization, Scikit-Learn simplifies building robust financial models, making it a cornerstone in Python-based financial analytics.

4.2. Implementing AI-Driven Financial Models

Python’s extensive libraries, including Scikit-Learn and TensorFlow, enable the implementation of AI-driven financial models. These models leverage machine learning algorithms to predict market trends, optimize portfolios, and assess credit risks. By integrating with financial data tools like Pandas, AI models can process large datasets, delivering accurate forecasts and enabling data-driven decision-making in trading and investment strategies.

Algorithmic Trading with Python

Python simplifies algorithmic trading by enabling the creation of automated strategies and backtesting processes, essential for efficient and data-driven trading decisions.

5.1. Building Trading Strategies Using Python

Python’s extensive libraries, including Pandas and NumPy, enable efficient development of trading strategies. By leveraging historical data and machine learning, traders can create customizable algorithms. Python’s simplicity allows for rapid prototyping and backtesting, ensuring strategies are robust before deployment. This flexibility makes Python a preferred choice for both novice and experienced traders in financial markets.

5.2. Automated Trading Systems and Backtesting

Python’s libraries, such as Pandas and NumPy, streamline the development of automated trading systems. Backtesting frameworks like Zipline and Backtrader enable traders to evaluate strategies using historical data. Python’s versatility allows for rapid implementation of algorithmic models, ensuring robust performance validation before live trading. This process minimizes risks and enhances decision-making in financial markets.

Risk Management in Finance

Python is essential for risk management, enabling statistical modeling and simulation. Libraries like NumPy and Pandas facilitate stress testing, while tools like Scikit-learn support predictive analytics for portfolio optimization;

6.1. Quantitative Risk Assessment Techniques

Python excels in quantitative risk assessment through advanced libraries like NumPy and Pandas, enabling efficient data manipulation and statistical analysis. Techniques such as Monte Carlo simulations and Value at Risk (VaR) are seamlessly implemented, providing robust tools for stress testing and portfolio risk evaluation. These methods ensure accurate forecasting and mitigation of financial uncertainties, enhancing decision-making in risk management.

6.2. Stress Testing and Portfolio Analysis

Python facilitates robust stress testing and portfolio analysis through libraries like Pandas and NumPy. These tools enable simulations of extreme market conditions, evaluating portfolio resilience. Advanced analytics and visualization libraries like Matplotlib help in assessing risk exposure and optimizing portfolio performance, ensuring informed decision-making for financial stability and growth in dynamic markets.

Financial Time Series Analysis

Python excels in financial time series analysis through libraries like Pandas, enabling efficient data manipulation and visualization. It supports advanced forecasting and statistical modeling, crucial for financial trend predictions. Additionally, Python’s capabilities extend to generating comprehensive PDF reports, making it an indispensable tool for data-driven financial insights.

7.1. Working with Time Series Data in Finance

Python’s powerful libraries like Pandas enable efficient handling of time series data in finance; Key features include parsing dates, managing missing data, and aligning datasets. Advanced manipulation techniques such as resampling and rolling windows are essential for analyzing financial trends. Integration with visualization tools like Matplotlib and Seaborn allows for creating detailed plots. Python also supports exporting these analyses and visualizations into PDF reports for comprehensive financial insights and reporting.

7.2. Forecasting Financial Trends

Python’s robust libraries like Prophet, ARIMA, and LSTM enable accurate forecasting of financial trends. These tools leverage historical data to predict future market behavior, managing risk and optimizing investment strategies. Integration with visualization libraries allows for clear presentation of forecasts, which can be exported as PDF reports for stakeholder analysis, enhancing decision-making processes in finance.

Python Libraries for Financial Analysis

Python’s libraries such as NumPy, Pandas, and Matplotlib are essential for financial data handling and visualization. They enable efficient data processing and PDF report generation, streamlining financial analysis tasks and enhancing productivity for professionals in the field.

8.1; NumPy and Pandas for Data Handling

NumPy and Pandas are cornerstone libraries for financial data handling. NumPy excels in numerical computations, while Pandas simplifies data manipulation with DataFrame structures. Together, they enable efficient processing of financial datasets, time series analysis, and integration with tools for generating PDF reports, making them indispensable for modern financial data analysis and visualization tasks in Python.

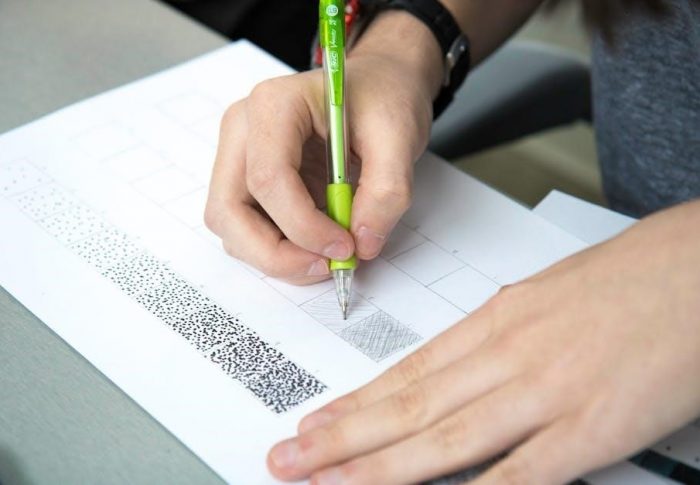

8.2. Matplotlib and Seaborn for Visualization

Matplotlib and Seaborn are essential for creating high-quality visualizations in financial analysis. Matplotlib provides comprehensive plotting tools, while Seaborn enhances aesthetics and statistical graphics. Together, they enable the creation of informative charts, heatmaps, and time series plots, aiding in data exploration and insights. Their integration with Pandas and NumPy streamlines the visualization process, making them indispensable for financial data analysis and reporting in Python.

Financial Modeling with Python

Python is a powerful tool for building financial models and simulations, enabling data-driven decision-making. Its flexibility and extensive libraries support complex financial analysis and reporting.

9.1. Building Financial Models and Simulations

Python is a cornerstone for constructing sophisticated financial models and simulations, leveraging libraries like NumPy and Pandas for data manipulation. Its versatility enables the creation of Monte Carlo simulations, portfolio optimizations, and predictive analytics. These tools empower professionals to analyze risks, forecast trends, and make data-driven decisions efficiently, making Python indispensable in modern financial modeling.

9.2. Monte Carlo Simulations in Finance

Monte Carlo simulations are widely used in finance for risk assessment and portfolio analysis. Python’s libraries, such as NumPy and pandas, enable efficient implementation of these simulations. They help quantify uncertainty by generating multiple scenarios, allowing professionals to make informed decisions. Yves Hilpisch’s work highlights the integration of Monte Carlo methods with Python for robust financial modeling and analysis, as detailed in his PDF resources.

Portfolio Management Using Python

Python is essential for portfolio management, enabling efficient data handling, optimization, and performance analysis. Libraries like pandas and NumPy streamline portfolio construction and risk assessment, while resources like Yves Hilpisch’s PDFs provide practical insights into implementing these strategies effectively.

10.1. Portfolio Optimization Techniques

Python is a powerful tool for portfolio optimization, enabling the use of advanced mathematical models and libraries like PyPortfolioOpt and PyAlgoTrade. These tools allow for efficient diversification, risk minimization, and return maximization. Modern Portfolio Theory (MPT) and mean-variance optimization are seamlessly implemented using Python, making it easier to analyze and optimize financial portfolios; Yves Hilpisch’s resources provide comprehensive insights into these techniques through detailed PDF guides.

10.2. Performance Metrics and Analysis

Python facilitates comprehensive performance analysis through libraries like Pandas and NumPy, enabling the calculation of key metrics such as Sharpe Ratio, Sortino Ratio, and Maximum Drawdown. These tools allow for detailed portfolio evaluation, risk assessment, and return analysis. Yves Hilpisch’s resources provide practical examples of implementing these metrics, while Matplotlib and Seaborn aid in visualizing performance data for clearer insights and reporting in PDF formats.

Real-World Applications of Python in Finance

Python is widely used in banking, investment management, insurance, and real estate for data-driven applications, financial modeling, and risk analysis, leveraging libraries like Pandas and NumPy for efficient data handling and visualization, often integrated into PDF reports.

11.1. Banking and Investment Management

Python is extensively used in banking and investment management for data analysis, risk assessment, and portfolio optimization. Libraries like Pandas and NumPy enable efficient data manipulation, while tools like Matplotlib and Seaborn provide visualization capabilities. Financial reports and dashboards are often generated in PDF format, streamlining communication and decision-making processes for professionals in these sectors.

11.2. Insurance and Risk Analysis

Python is increasingly used in insurance for risk analysis, actuarial calculations, and fraud detection. Libraries like Pandas and NumPy handle large datasets, while Scikit-learn enables predictive modeling. Insurance companies leverage Python to generate detailed PDF reports, ensuring accurate risk assessments and efficient policy management. This versatility makes Python indispensable in modern insurance and risk management practices.

The Future of Python in Finance

Python’s future in finance is promising, driven by advancements in AI, machine learning, and big data integration. Its ecosystem continues to evolve, enabling innovative financial solutions and PDF-based reporting.

12.1. Emerging Trends and Innovations

Python’s role in finance is expanding rapidly, driven by advancements in AI, machine learning, and big data. Emerging trends include AI-first finance, real-time data processing, and automated decision-making. Innovations like Python’s integration with cloud platforms and advanced libraries enable faster and more accurate financial modeling, positioning Python as a cornerstone for future financial technologies.

12.2. Integration with AI and Big Data

Python’s integration with AI and big data is transforming finance through advanced analytics and machine learning. Libraries like TensorFlow and PyTorch enable predictive modeling, while tools like Pandas and NumPy handle large datasets efficiently. This integration facilitates scalable solutions, enhancing decision-making and driving innovation in financial analytics and modeling.

Educational Resources for Python in Finance

Discover comprehensive educational resources for Python in finance, including books like Python for Finance and online courses, designed to enhance skills in financial data analysis and modeling.

13.1. Recommended Books and Tutorials

Explore top-rated books like Python for Finance by Yves Hilpisch and Quantitative Finance with Python by Chris Kelliher, offering in-depth insights into financial data analysis and algorithmic trading. These resources, often available in PDF format, provide practical examples and tutorials for mastering Python in finance. Online courses and tutorials further complement these books, ensuring a well-rounded learning experience for professionals and students alike.

13.2. Online Courses and Communities

Enroll in online courses like Python for Finance on Coursera and edX, which offer hands-on training in financial data analysis and machine learning. Additionally, communities such as GitHub, Stack Overflow, and specialized finance forums provide valuable resources and support for learning Python in finance. These platforms foster collaboration and offer practical insights, helping professionals and learners stay updated with industry trends and tools.

Case Studies in Python for Finance

Real-world applications of Python in finance include portfolio management, risk analysis, and algorithmic trading, showcasing its effectiveness in driving data-driven decision-making and innovation.

14.1. Successful Implementations in Financial Institutions

Major financial institutions have successfully implemented Python for data analysis, algorithmic trading, and risk management. Banks and investment firms utilize Python’s libraries for portfolio optimization and predictive modeling. Yves Hilpisch’s work highlights Python’s role in derivatives analytics and financial simulations, demonstrating its effectiveness in real-world applications across banking, insurance, and asset management sectors.

14.2. Lessons Learned and Best Practices

Financial institutions emphasize collaboration between data scientists and finance experts for effective Python implementations. Version control with Git and thorough code testing are crucial; Starting with small projects ensures scalability. Leveraging libraries like Pandas and NumPy for data handling, and Jupyter Notebooks for interactive analysis, enhances productivity. Community support and continuous learning are key to overcoming challenges in financial applications.

Tools and Frameworks for Financial Development

Jupyter Notebooks enable interactive data analysis, while Git ensures version control. Libraries like Pandas, NumPy, Matplotlib, and Seaborn provide robust tools for financial data manipulation and visualization.

15.1. Jupyter Notebooks for Financial Analysis

Jupyter Notebooks provide an interactive environment for financial analysis, enabling the mixing of Python code, visualizations, and explanations. They are ideal for data exploration, prototyping, and reporting. Their flexibility supports collaborative workflows and documentation, making them a cornerstone for data-driven finance and AI integration in modern financial applications.

15.2. Using Git for Version Control in Financial Projects

Git is essential for version control in financial projects, enabling teams to track code changes and collaborate efficiently. It ensures consistency and transparency, critical for compliance and auditing. Git integrates seamlessly with tools like Jupyter Notebooks, enhancing workflow management. This makes it a cornerstone for maintaining code integrity and facilitating collaboration in complex financial applications and data-driven projects.

Python empowers finance professionals with versatile tools for data analysis, machine learning, and reporting. Its extensive libraries and resources, like PDF guides, foster innovation and efficiency in financial applications.

16.1. Summary of Key Concepts

Python’s flexibility and extensive libraries make it a cornerstone in finance, enabling efficient data analysis, financial modeling, and PDF report generation. It supports machine learning, visualization tools like Matplotlib, and seamless integration with financial data, fostering innovation and efficiency in the industry.

16.2. Final Thoughts on Python’s Impact in Finance

Python’s versatility and powerful ecosystem have revolutionized finance, enabling efficient data-driven decision-making and AI-first approaches. Its extensive libraries and tools empower professionals to generate PDF reports, analyze time series data, and build predictive models. As a cornerstone of modern finance, Python continues to drive innovation, efficiency, and growth across the industry.